A Green Recovery can make Southeast Asia an Economic Powerhouse

In the midst of its COVID-19 economic recovery efforts, China announced a plan to achieve carbon neutrality by 2060. This surprise announcement at the United Nations General Assembly in September is a significant boost to the global effort to address climate change, given China’s responsibility for almost a third of the world’s emissions. But the timing of the announcement is also notable. Even during the global pandemic, China sees the best path for economic recovery and post-pandemic growth as a green one, with the country’s president Xi Jinping calling on all countries to “seize the historic opportunity” of scientific and technological innovation to build back greener.

But while China’s commitment to net zero emissions is a much-needed boost for global climate action, we would be naive to think that it is driven purely by altruism. Carbon Brief estimates that the significant infrastructure investment required to steer the country’s massive economy towards its net zero end goal could spur China’s GDP to grow an additional five per cent this decade. Importantly, China already dominates the manufacture of low carbon technologies, such as wind and solar power, advanced grid technology, battery storage, and electric vehicles. It also controls much of the world’s supplies of the rare earths and minerals required for the production of renewable energy technologies.

It is safe to assume China is making a calculated geopolitical move. So, the green race is on.

Southeast Asian nations should take heed. Over the next few years, this region’s major economies will steer billions in domestic and international finance towards infrastructure and business investment, in an effort to regain the levels of economic growth experienced in the recent past. While COVID-19 continues to wreak socio-economic havoc across the Association of Southeast Asian Nations (ASEAN) members, the recovery provides a unique opportunity to fast track the transition towards green growth.

With China and the European Union (EU), amongst the world’s top three economies, now committed to net zero targets by mid-century, the only safe bet for long term economic prosperity is one that prioritises green growth. Just like in the first Industrial Revolution, countries that get a head start in the green race today will be the major economies of tomorrow.

China’s cards are now clearly on the table.

In 2019, ClimateWorks and Vivid Economics published research that found that Asia – in particular, China, Japan and South Korea – already leads the global green race. But developing Asia is on the cusp of competitiveness in low-carbon technologies. A decisive and coordinated push as part of COVID recovery efforts can ensure that ASEAN pivots towards green growth faster than expected.

In the first half of 2020, ASEAN became China’s largest trade partner, in part due to deteriorating bilateral relations between China and the United States and extended lockdown measures in the EU. The strengthening trade relationship is seeing rapid growth in ASEAN exports to China of electronics components such as semiconductors and integrated circuits that are primarily used in electronic equipment but can also be used also in low carbon technologies such as smart meters, renewable energy technologies and smart appliances. As the United States squeezes China’s access to US technology, China is responding by rapidly building a new supply chain in Southeast Asia. This represents an extension of China’s industrial chain, with ASEAN-based facilities still relying on raw materials, equipment, expertise and technology from China.

We are seeing similar moves by South Korea and Japan, the other two low-carbon technology leaders, attracted to ASEAN by lower wage structures, improving infrastructure and a supportive legal environment. These moves are consistent with rising regional trade integration between ASEAN, China, Japan and Korea, both as a counterweight to the rise of protectionist policies increasingly adopted by the US, but also to enhance the resilience of these economies to future volatility shocks.

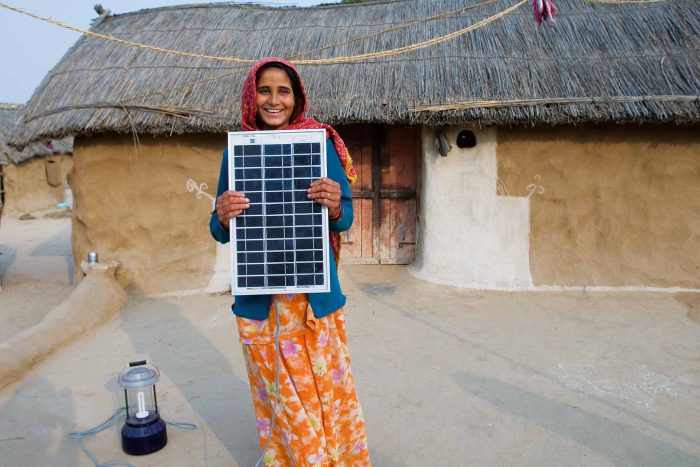

Close trade relations with low carbon global leaders can benefit ASEAN member states through enhancing access to low carbon technologies, the costs of which can be expected to rapidly decline as China invests in scaling up production. This will likely mean the cost of renewable energy generation falls faster than anticipated, making clean, accessible, low cost and secure energy a near term eventuality that can benefit ASEAN member states in achieving their energy and climate goals.

A focus on scaling up supply of resources and components to meet the growing hunger of China, Japan and South Korea for low carbon technologies provides clear opportunities for economic diversification. Scaling up usually involves an increase in foreign direct investment (critical to stimulate COVID recovery) and importing expertise from the country sourcing that technology. As China found in the 1990s when it first ventured into the production of solar panels, this can trigger a rapid growth in skills and capabilities in the domestic manufacturing sector. With the right policy settings, it could catalyse the development of advanced low carbon technology manufacturing capabilities across the ASEAN region.

But there is a further strategic play in the offering here for the ASEAN region. For ASEAN member states to achieve their climate commitments, significant investment in clean energy, low or no emissions vehicles, and a significant push in energy efficiency will be required. As the region builds capability to service the needs of China, Japan and Korea, there should be a dedicated focus on strengthening and expanding regional supply chains for low carbon technologies.

These two prongs, pursued in parallel, provide ASEAN with a once-in-a-lifetime opportunity to recover from the global pandemic, riding on the coattails of China’s green leap forward to become global leaders in the manufacture and export of low carbon technologies.

While this strategy may provide a critical lifeline out of the COVID economic downturn for the ASEAN region, it is important to flag that this strategy is unlikely to be well received by other key ASEAN trade partners, the US and Australia. China’s move to strengthen trade with the ASEAN region is seen as a tactic to achieve regional hegemony. But in the vacuum of moral and political leadership on climate change left by the US and Australia, what viable alternatives are on the table to spur economic recovery in the ASEAN region while also setting track for a climate-safe and economically-resilient future?

For ASEAN, existing trade relations with China, Korea and Japan provide the opportunity for a green recovery. As the ClimateWorks and Vivid Economics 2019 research demonstrated, the region’s emerging low carbon technology strengths provide the means.

To date, we have studied three ASEAN countries – Vietnam, Indonesia and the Philippines – chosen because of their high rates of both emissions and economic growth. Our research found that each country has unique and complementary strengths in low-carbon technologies, which can decrease their dependence on fossil fuels, enhance their energy security, and open up opportunities for stronger regional and global trade to achieve greater economic diversification.

Of the three countries studied, Vietnam stands out as a clear low-carbon technology leader. Vietnam is already a specialist in components required for smart grids, solar PV and energy storage. This reflects its export and innovation specialisation in electronics manufacturing. For instance, semiconductor devices used to manufacture solar PV cells are closely related to the production of other optical devices, TVs and radios. Expanding this production capability with a specific focus on providing componentry for regionally manufactured solar panels can create a higher value-add industry to complement its comparative strength in electronics.

Vietnam also provides a compelling example of how Southeast Asian countries can not only benefit from regional supply chains but also carve out a competitive niche to compete with global low carbon leaders. The GE plant in Hai Phong provides one such example. The plant employs 500 staff to produce wind turbine generators, electrical control systems and fabrication components, with intentions to scale up as part of a localisation strategy. The location of the plant is also instructive. It was chosen for its proximity to China. It allows GE to make cheaper parts in Vietnam and export them over the border to China.

While China is a global powerhouse in the production of wind turbines, Indonesia’s strong steel production and nascent wind tower capability mean that it already has an emerging comparative advantage in wind turbine production – surprisingly so for a country with virtually no domestic installed wind generation capacity. Indonesia also benefits from extremely low manufacturing costs (one-fifth of those in China), which means it is well positioned to scale up wind tower manufacturing to value-add to the regional supply chain.

While China may now control a significant proportion of the world’s rare earths and minerals used in low carbon technologies, Indonesia has been moving to regain control of its rich endowments of nickel and bauxite (both used in battery storage) to fast track growth in electric vehicle production. Indonesia plans to scale up domestic production of two, three and four-wheel EVs, with minimum required rates of local components and plans to expand charging infrastructure. This will also increase foreign direct investment (through requirement for assembly and components manufacturing facilities to be based in-country), and allow the country to become a major producer of lithium-ion batteries. PT Pertamina, Indonesia’s state-owned oil and natural gas corporation, has signaled its intention to be the biggest lithium ion producer in the country. Coordination with demand for these technologies from other ASEAN countries could further boost Indonesia’s production scale and export competitiveness.

China may be the largest global exporter of solar photovoltaic (PV) panels, but the Philippines already has a well-entrenched comparative advantage in this technology, exporting seven times the global average in solar PV components. With technology transfers and specific innovation strategies, the Philippines can match domestic production with burgeoning regional demand, building its competitiveness against Chinese solar panels.

The opportunity for economic diversification could not come at a better time for ASEAN countries. The reduction in global demand for fossil fuels as a result of the pandemic has hit the coffers of commodity exporters, on the back of lower commodity prices for fossil fuels over the past two decades. In a world awash with supply, and with demand evaporating due to COVID lockdowns, the region’s fossil fuel businesses are facing unprecedented declines in profitability, with stark implications for state revenues in Indonesia, Malaysia, Vietnam, Thailand and Brunei. China’s carbon neutral announcement sends another blow. While it will take some time for China to fully wean itself off these commodities, the death knell is beginning to toll for fossil fuels as a source of sovereign wealth.

But for cash-strapped governments, where will this investment in green recovery come from? For starters, ASEAN countries could seize the opportunity provided by current low fossil fuel prices to phase out pervasive subsidies that waste finite fiscal resources, allowing these resources to be used elsewhere to stimulate economic recovery. Such a shift would have the added benefit of levelling the playing field for clean energy technologies, which could help to accelerate the uptake of low carbon technologies across the region. As ClimateWorks recently outlined, finite government fiscal resources can be used alongside policy signals to strengthen the investment environment for private and foreign direct investment in low carbon industries and infrastructure. This ensures maximum bang for buck for each dollar of public money spent, and enables the transformational investment required to catalyse the shift towards net zero.

This is not some far-fetched dream. The developing countries of Asia have demonstrated higher innovation expertise than the US but need to bolster production capability to create a clear comparative advantage. Regional cooperation – to build supply chains that can meet the needs of China, South Korea and Japan while also servicing ASEAN countries’ growing demand for low carbon technologies – provides the means to do this quickly. The ASEAN region has geographic proximity to global leaders, an increasingly attractive investment environment, an educated population, and lower manufacturing costs than Japan, Korea and China. When combined with the scale of investment needed to kick-start economies post-COVID, ASEAN has all the ingredients for a successful and rapid low carbon transition.

The question is, how will it use them?