Slingshot Theory Of Food Disruption – Lessons In Adaption

2020 has been a year of disruption. A year that started with devastating bushfires in Australia quickly rolled into a global pandemic that continues to disrupt lives and livelihoods globally. Meanwhile in food and agriculture, images of dumping milk, shuttered processing plants and empty shelves have highlighted the complexity and fragility of global food supply chains.

And perhaps as the global demand for food grows and consumers stockpile toilet paper and yeast for baking we already have a glimpse into the future when people, profit and the planet are all under conflicting stress.

Growing up we likely all experimented at some point with slingshots, pushing the boundaries of elastic potential, experimenting with new techniques while trying to avoid the pain that comes with failure. So it goes in the current age of disruption in the food and agriculture industry.

Three slingshot scenarios of food disruption (stretch, snap and spring) have emerged that allow us to pause to reflect on what changes are occurring, where they are impacting and how progressive policy frameworks and investment in innovation and technology can help deliver a safe, secure and sustainable food production systems. These three elements that will help the food and agriculture industry focus on informed innovation as we exit from the pandemic towards the new normal.

-

Stretch – modern day natural selection

As food systems are stretched, a Darwinian-like theory emerges. Like cavemen running from T-Rex, adaption in food production systems becomes a matter of survival. Under tension, reallocation of resources and a shift in innovation investment is a risk mitigation response that helps both businesses and policymakers adapt.

Numerous countries have been impacted by food shortages during 2020. In Singapore some supermarket shelves emptied temporarily due to rumours of a border closure with Malaysia, particularly fresh fruit and vegetables. In fact this supply shortfall highlighted the importance of communication, where there were in fact no COVID-19 related border controls for food imports, only border controls relating to people commuting for work.

Singapore has long considered food security a priority (along with the existential threat of climate change and sea level rise), building strong trading partnerships and investing in increasing domestic food production through the “30by30” initiative. This has driven recent significant investment in developing capability and capacity of Singapore in aquaculture, vertical farming and cellular agriculture production systems, while building innovation competencies in processing, packaging and waste management signalling a significant shift towards a circular economy for an island city-state with comparatively constrained natural resources.

For Controlled Environment Agriculture (CEA), the Singapore Government recently awarded several 30by30 express grants to several companies committed to expanding operations in Singapore, including locally based ComCrop and German-based &ever. Continued focus on reducing input costs relating to energy will be key to achieving viable return on capital. In addition, selection and development of varieties that are designed specifically for vertical farming will improve productivity, a focus of Unfold, a new company backed by Bayer and Temasek.

On the other side of the equation, the issue of food waste is only now coming into sharp focus. Collectively food waste from crops, processing, supply chain, retail and households is estimated to account for up to 50 per cent of all food produced. Recently, media images of dumped and rotting milk, meat and vegetables have raised awareness as to how our current food chain operates (or doesn’t)..

As the circular economy develops, policymakers need to adapt regulations to encourage mainstream use of waste streams and reclaimed nutrients in domestic food production systems. This follows the development of innovation in recycling “new water” for reuse where Singapore has played a lead role.

A trend towards valorisation of aseptic grade fruit and vegetables into value-added and consumer products is taking advantage of waste streams generated through crops, processing, supply chain and distribution food waste streams that contribute up to 50 per cent of all food waste. Confetti Fine Foods, a Singapore-based company repurposing excess vegetables into nutrient dense snacks, recently launched and is currently focused on the global US$188bn flavoured snack market currently dominated by potatoes. Aquabotanical, an Australia-based company, is also leading in upcycling waste water from processing fruit and vegetables. This unlocks the potential to use vitamin rich water as a value-added ingredient for food and beverage companies, while unlocking access to new sources of drinking water for rural and remote communities globally through the Aquabotanical Foundation.

Meanwhile growing demand for food, driven by Asia, continues unabated. History tells us that pursuing any one panacea is a risky endeavour. As future demand for protein (and food generally) is driven by Asia, simultaneously augmenting multiple sourcing channels to meet incremental demand will be critical.

A solution to safe, secure and sustainable protein likely rests somewhere in the majority mainstream: growing a flexitarian consumer base eating smaller portion sizes of higher quality meat less regularly. The real opportunity comes where industries build bridges and common ground, acknowledging that many farmers who grow crops (e.g. wheat and legumes) also raise livestock, both key protein sourcing channels.

In Australia various livestock and crop industry sectors need to proactively collaborate in order to drive innovation and secure market access opportunities for export. Currently consumer demand is driving innovation and investment in all forms of protein production, particularly in plant protein and cellular agriculture. These have been fast-tracked under COVID-19, putting a spotlight on the intensive animal production industry and the potential to augment protein supply for a growing global population. The silver lining to this focus sees innovation in animal production systems. Animal Eye is a Singapore-based startup developing chain of custody solutions for the livestock transport sector, aiming to bring data driven transparency, trust and a focus on animal welfare. Meanwhile FutureFeed is a CSIRO innovation that looks to reduce methane emissions from livestock operations.

There are polarised positions around sustainability, health and unit economics of new protein production technologies that are still in early stage development, particularly for cellular agriculture. Meanwhile venture capital is fuelling a certain degree of hype and delivering significant capital required for early stage research into scaffolding, nutrient media and production scaling on the promise of return multiples. Recent examples in Singapore include Shiok Meats, a business focused on crustacean production alternatives and making strong progress in prawns and recently lobster.

In Australia, a collaborative effort in company creation between CSIRO, Main Sequence Ventures and Jack Cowin (Hungry Jacks) laid the foundation for the launch of plant-based V2Foods . CEO Nick Hazel believes that the company can bring significant synergies together with traditional livestock meat production operations in supporting Australia’s claim to a safe, secure and sustainable protein platform. Likewise Fable Foods is innovating in mushroom-based meat alternates, utilising the waste stems of shitake mushrooms for products with a meat texture, both in the form of base product and ready to use meal kits.

There has also been an adaption of sorts in food in go to market models. Growth in B2C (e.g. online grocery and home delivery) has come at the expense of hotel, restaurant and café businesses that are restricted under current social distancing regulations. During the COVID-19 period consumers have grown increasingly familiar with e-commerce food platforms such as Redmart has experienced a 400 per cent increase in business and hired an additional 500 staff since April 2020. At the same time GrabFood deliveries are up an estimated 60 per cent since Q4/2020, driven by increased home office/entertainment trends. Although there has been a traditional city-country disconnect about where and how food is produced, conscious consumers increasingly aware of waste are finding a voice and savvy business owners are responding.

-

Snap – dinosaurs and meteors

Major disruption comes when a system snaps under intense pressure from an event, resulting in major restructuring and a seismic shift towards a new normal. And COVID-19 is a meteor-like snap event for a number of food and agriculture related businesses, and a number of dinosaurs are set to fail.

The processing sector has experienced significant impacts, particularly where people have traditionally undertaken key operations. Large scale abattoirs and meat processing plants have been hardest hit, where reduced labour availability (due to quarantine or distancing protocols) has restricted operations or resulted in a complete shutdown, impacting both upstream production demand and downstream supply. Food safety and consumer health concerns are likely to drive investment in automation, a risk mitigation strategy where robotics replace dirty, dangerous, dull and dumb processing operations typically. Businesses that cannot afford the investment are likely to come under increasing pressure and some will not survive.

Airfreight has experienced severe disruption and likely far reaching consequences for global supply chains. The growth in air travel has enabled fast transport of food compared with seafreight, unlocking new global markets for out of season produce with an “any food, any time, anywhere” promise to buyers and consumers alike. However as airlines have universally restricted operations, options for airfreight have suddenly become limited and expensive. Markets were closed almost overnight, and industries such as the northern Australia crayfish sector lost critical access to China without the ability to divert or delay.

In response, the Australian Federal Government implemented a $240 million emergency logistics initiative in July 2020, recognising the impacts of restricted supply chains for Australian producers. Despite a recent announcement by QANTAS to increase flights to 50 per cent of pre-COVID-19 levels by mid-2021, restrictions are set to continue to disrupt airfreight export channels.

Global food and agriculture conferencing and trade shows, like other sectors, have been massively disrupted due to air travel and social distancing restrictions. Traditionally regarded as must-have for content and client-facing business development activities (particularly in Asia), businesses have shifted focus to in-country growth through proxy networks. Online events, when well-structured and respectful of the target audience, can have a significant advantage in delivering cost-effective and quality online content, delivered in a format that provides genuine interaction, engagement and connection. New forms of interactive conferencing platforms have already emerged such as the recent edition of Rethink that provides participants with a high quality experience including panels, round tables and networking. Globalisation has delivered significant inter-country interdependencies on both production supply chains and markets, where China has subsequently emerged as a core basic and intermediate materials supplier. Renowned as a significant producer of high quality produce and despite recent steady progress, Australia arguably continues to be commodity export focused.

On the assumption that the COVID-19 era continues to deliver significant disruption to food supply chains, policymakers need to shift focus to attract investment in vertically integrated intra-country infrastructure that supports value-adding industries. In response to the increasing need for innovation in the food and agriculture sector, several new AgriFoodTech accelerator programs have emerged in Singapore, supported by funding from Enterprise Singapore and Seeds Capital. These include GROW and Big Idea Ventures both supported by venture funds aiming to scale growth companies and establish a new AgriFoodTech hub in SouthEast Asia.

There are as-yet untapped synergies in bridging to well established Australian Agtech accelerator programs such as SproutX and SparkLabs Cultiv8. It is critical that post-accelerator companies are able to access new growth markets in Asia, and a focus on challenge led innovation (rather than technology alone) that delivers scalable solutions with a clear business case will help secure commercial offtake agreements, drive revenue and access capital.

-

Spring – a return to business as usual?

During all the chaos and disruption of the pandemic, there are major elements of primary food production that have remained surprisingly resilient under stress and return to a status quo.

Large scale broadacre agriculture, by and large, is already a relatively isolated occupation. Where farmers have access to technology (such as machinery, storage and handling equipment and digital tools). Human interaction is minimised and there is by definition a form of social distancing already in place. In contrast, intensive fruit production continues to suffer from lack of seasonal labour mobility for harvest traditionally sourced from the seasonal workers program, and consisting of backpackers, migrants and Pacific Island citizens on temporary visas. Recent data from the Australian Government indicates a 37 per cent decrease in labour from 135,000 (2019) to approximately 85,000 (June 2020). This is likely to prompt further investment in robotic harvesting technology for larger operations, and new companies such as the Australia-based Agerris, led by renowned University of Sydney robotics expert Salah Sukkarieh are developing solutions in this area.

Inputs such as animal genetics, crop protection chemistry, seed and fertiliser have been stretched across regional supply chains but so far without significant impacts. CropLife Asia, the peak body representing leading multinationals involved in the crop protection and seeds industry across the Asia-Pacific region, has been working with member companies to ensure supply channels for critical inputs remain open.

Current disruptions to supply chains are also likely to continue to drive companies toward better demand forecasting systems that are more agile and utilise adaptive learning to meet market demands while reducing variability in production supply cycles. Meanwhile the long term implications of disruption to long cycle investments in animal (meat and dairy) genetics and COVID-19-related destocking of breeding programs are yet to be determined.

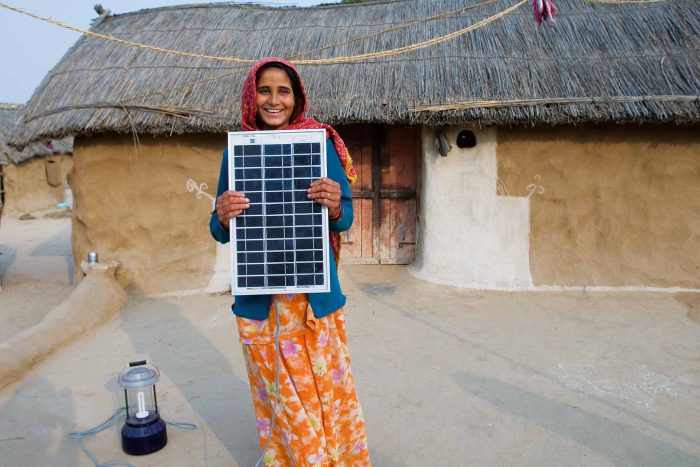

While smallholder farmers across Asia are among the most efficient food producers, and built around a solid intergenerational family unit, they also continue to rely heavily on manual labour. Located in remote and regional rural centres, impacts on smallholders are commonly driven by fluctuating demand cycles, lack of technology access (e.g. storage facilities) and cashflow/capital.

2021 – A slingshot year in food production?

As we look forward to 2021 and hopefully a breakthrough in vaccines that help manage the pandemic, there are important lessons and learnings that collaboration and innovation that will continue to deliver resilience and adaptation. Necessity is the mother of invention after all.

The Comprehensive Strategic Partnership and CSIRO-A*STAR collaboration between Singapore and Australia are both solid platforms that can help address sovereign risk in food supply while supporting cross-country trade growth along with investment in food system and waste stream innovation. Within this framework, sharing experience, expertise and knowledge in a challenge-led innovation approach to addressing priority issues are key ingredients to a resilient food system. More can be done to help facilitate this exchange between industry, investors, innovators and policymakers.

Collaborative cross-border challenge programs such as GRAFT from Beanstalk, funded by CSIRO, and the Food System Vision Prize coordinated by SecondMuse and funded by the Rockefeller Foundation, aim to bring together multiple stakeholders across government, industry and investors to help address priority challenges and drive innovation in food systems.

AUSTRADE also has a key role to play in positioning Australia as a reliable and sustainable source of trade in food and beverages, while industry works with investors to scale production and processing platforms.

Notwithstanding the efforts of Australian quarantine and border controls, one could also argue that the COVID-19-driven disruption is somehow a practice drill for future pandemics and arguably more existential threats such as climate change and resource-related geopolitical conflicts. These would likely severely impact Australia’s ability to supply a sufficient quality and quantity of food to a growing, diverse population both domestically and via export markets.

How we learn from the food disruption lessons of 2020, our annus horribilis, and slingshot in 2021, will be key to how we adapt to the new normal.