What the Green New Deals mean for Australia and Southeast Asia

Aligning economic recovery from the COVID-19 pandemic with sustainability goals has been a focus in recent ‘Green New Deals’ developed in Europe and the US. The pandemic hit Australia before there was time to recover from the unprecedented 2019-2020 bushfires. This was highlighted by the Australian Royal Commission into National Natural Disaster Arrangements, appointed in response to the extreme bushfires, being required to conduct its hearings throughout 2020 by video-link.

Australia, like other countries in the region, faces the multiple challenges of economic recovery from the pandemic impacts, improving our responsiveness and resilience to climate-related natural disasters (which will continue to face the region) and mapping a clear path to achieving the commitments of the United Nations Paris Agreement of “holding the increase in the global average temperature to well below 2̊C above pre-industrial levels and to pursue efforts to limit the temperature increase to 1.5̊C above pre-industrial levels.”

What does a sustainable recovery look like and what role will the Green New Deals emerging in Europe and the US play in a sustainable recovery from the COVID-19 pandemic in Australia and Southeast Asia?

Despite commitments to meeting the United Nations Framework Convention on Climate Change (UNFCCC) Paris commitments and setting of 2050 climate targets, governments are constrained by tight budgets, lack of political will and the necessity of political compromise, and competing policy priorities. This is particularly so following the pandemic. But the pandemic, climate-related disasters, and geopolitical changes to follow the US Presidential election, create a convergence of priorities that are being channelled into a sustainable recovery. The European and US New Green Deals, and variants of this in our region, provide a framework for a sustainable recovery with the core components being the promotion of climate resilient infrastructure and low emission technologies and leveraging public and private finance to invest in clean energy and infrastructure. These are the other important (less quoted) commitments of the Paris Agreement: “increasing the ability to adapt to the adverse impacts of climate change and foster climate resilience and low greenhouse gas emissions development, in a manner that does not threaten food production… and making finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development.”

The concept of a green new deal as articulated by economic theorist Jeremy Rifkin was based on the emergence of the concept and plans in Europe and then the Green New Deal resolution introduced into the US House of Representatives in February 2019. The green new deal concept, according to Rifkin, involves a comprehensive range of measures and initiatives to speed the transition of the economy and society to a low-carbon, sustainable and resilient future and address climate change. These include: a range of reforms to taxes and subsidies; tax credits and incentives for investment in renewables and low carbon technologies; enhancing electricity network connections; incentivising uptake of electric vehicles and installation of charging stations; green infrastructure and green buildings; sustainable agriculture; upgrading resilience of existing infrastructure to severe weather events; improve climate change-related disaster preparedness; leveraging investment and lending for the new green deal economy; education, training and research & development focused on the new green deal economy; and development of standards, codes and regulations which support this transition.

The key components emerging in many of the green new deal-like plans in the US, Europe, Japan and South Korea are carbon emission reduction commitments (net zero by 2050); fast-tracking of infrastructure, particularly low emissions technology (in energy projects, waste and resource recovery and smart cities): leveraging public and private money for low emission technology projects; and supporting transition to a green economy. This is consistent with recent strategies adopted by Southeast Asian countries at their November meeting (outlined below) and in many of the Australian policy responses and budgetary commitments (however limited) to economic recovery from the pandemic.

The components of the EU Green New Deal agreed to by the European Commission includes three concrete actions: a Just Transition Mechanism to leverage public and private money, including the European Investment Bank, to help those that are most affected by the move towards the green economy; delivery of a Sustainable Europe Investment Plan – mobilising €1 trillion of investment for environmentally responsible projects; and a proposed European Climate Law to make the net zero by 2050 commitment legally binding.

In the US, the Biden-version of the Green New Deal is not as far reaching as the original Ocasio-Cortez resolution, but many of the core elements are there. President-elect Biden has committed to a US$2 trillion clean energy and infrastructure plan, to re-join the UN Paris Agreement on climate change and a goal of net-zero emissions by 2050. China has pledged to reach to reach net zero emissions by 2060 and to cause emissions to peak by 2030, and Japan and South Korea have both recently endorsed the net zero by 2050 target. While the Australian Government has not yet endorsed this target, all the Australian States and Territories have committed to net zero emissions by 2050.

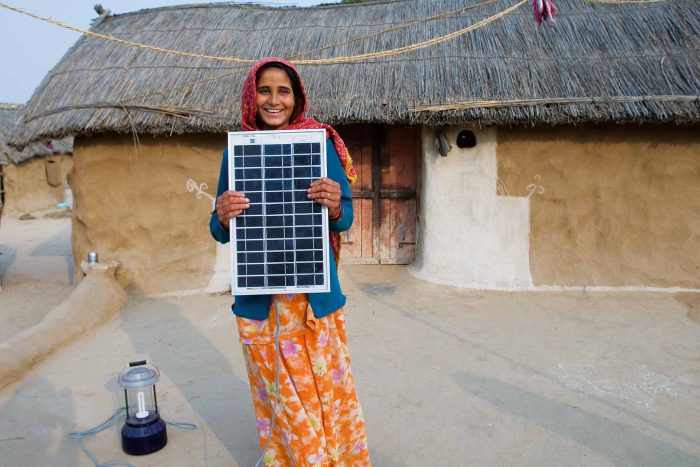

Recent infrastructure investment in Southeast Asia potentially puts the region on the cusp of a Green New Deal. In Disruptive Asia article ‘A Green Recovery can make Southeast Asia an Economic Powerhouse’, Megan Argyriou, documents the leading position of China, Japan and South Korea in the development of low-carbon technologies and the growing opportunity in countries in the region including Vietnam, Indonesia and the Philippines.

The 37th Association of Southeast Asian Nations (ASEAN) Summit held online on 12 November 2020 adopted an ASEAN Comprehensive Recovery Framework and Implementation Plan. It includes five key strategies: (1) enhancing health systems; (2) strengthening human security; (2) maximising the potential of intra-ASEAN market and broader economic integration; (4) accelerating inclusive digital transformation; (5) advancing towards a more sustainable and resilient future.

Strategy 5, consistent with the UN 2030 Agenda for Sustainable Development includes: promoting sustainable development in all dimensions; facilitating transition to sustainable energy; building green infrastructure and addressing basic infrastructure gaps; promoting sustainable and responsible investment; promoting high-value industries, sustainability and productivity in agriculture; managing disaster risks and strengthening disaster management; promoting sustainable financing.

The Framework states: “This Broad Strategy emphasizes that a return to ‘business as usual’ is no longer be an option for ASEAN in the postpandemic world, and this paradigm shift will require ASEAN governments, businesses, and civil society to work collectively to enable systemic change needed by the region for a sustainable and resilient future.”

The language of the green new deal has not as yet resonated in Australia, but has recently been getting more attention. The Australian Climate Change Authority has released publications which focus on the role of low-emission energy in economic recovery from the pandemic, for example, Economic recovery, resilience and prosperity after the coronavirus released in July 2020. The Australian Government has budgeted for further investment in renewables and waste and resource recovery infrastructure, and the States and Territories are committed to increasing renewable energy through reverse auctions and renewable energy zones. These are key components of plans in Europe and US which promote decarbonising the energy sector and circular economy.

In Australia, the recent focus has been on legislative reform and programs to fast-track development and infrastructure projects. The States have responded to the COVID crisis with various emergency reforms to planning and environmental legislation to address the immediate flexibility required for responses to the pandemic and to provide greater flexibility and centralisation of decision-making. The Federal Government and State Governments have identified key developments and infrastructure to be fast-tracked for assessment and approval to support economic recovery from the pandemic.

Recent reforms and programs in Victoria and New South Wales have focused on identifying and processing priority projects for fast-tracking. The criteria for identifying priority projects for fast-tracking include sustainability considerations – for example, Victoria’s criteria highlight net community benefits including social and affordable housing and environmental sustainability and NSW’s participation criteria also include public benefits – social benefits (such as affordable housing, community facilities) and environmental benefits (including renewable energy). Projects approved under these fast-tracking mechanisms have included residential, commercial, civic and renewable energy projects.

Climate mitigation and adaptation will be enormously expensive in the short-term, requiring trillions of dollars of investment in low-carbon and climate-resilient infrastructure. Governments cannot fund this transition. To bridge this gap in financial resources, the Paris Agreement expressly calls for mobilising private sector financing to support the enormous investments in green technologies and infrastructure that will be necessary to realize these sustainable transition and carbon emissions goals. ESG screening of investments and shareholder activism, and more recently climate change litigation, is influencing investment decisions. Sustainable finance (green loans and sustainability linked loans), corporate renewable power purchase agreements, green bonds (and the growing market of green, blue, climate, biodiversity, sustainability and social bonds) are playing a significant role in leveraging private capital. Multilateral development banks (such as the World Bank and Asian Development Bank) and the Clean Energy Finance Corporation in Australia, in conjunction with institutional investors such as superfunds, are catalysing private investment in a sustainable recovery.

Whether we like the terminology or not, the green new deal is coming to Australia and the region. The pace at which this occurs is likely to increase in 2021 as a COVID vaccine becomes available, Europe gets back on its feet, the new US Administration gets to work and the world renews its focus on addressing climate change at the UNFCCC Conference of the Parties in Glasgow, UK in November 2021. Australia and Southeast Asian countries are well placed to deliver on the ‘sustainable and resilient future’ strategy of the ASEAN Comprehensive Recovery Framework, leverage existing knowledge, technology and experience and cooperate to deliver a low carbon transition supporting economic recovery and future growth in the region.

King & Wood Mallesons paralegal Stephanie Cavoli assisted in conducting research for this article.